As a property manager, the rules your rental must abide by come down to a few important definitions. Staying on top of these can make it much easier to understand a lot of the nitty-gritty – from how much tax you’ll need to pay on your asset, to how many weeks a tenancy can be.

Today, platforms like Airbnb are making it easier than ever for travelers to search for short-term rental properties that will host them for days or weeks at a time. Properties are easy to find. But the actual definition of short-term rental can be a lot more elusive.

What is a short term rental – according to state law?

What are short term rentals – and how long is a short term rental (STR) allowed to host tenants for at one time? This also begs the question: when does a short-term rental become a mid-term or long-term rental? As a new or seasoned property manager, these are good questions to be asking – because staying within regulations depends so much on their answers.

So what are they? What does short term rental mean – exactly?

Well, it depends. These definitions aren’t universal. Just like the parking fees (and fines) we pay depend a bit on where we leave our car, different sets of rules and regulations apply to properties depending on where they’re parked across the globe. But for now, we’ll take a closer look at what defines a short-term rental in the US – and get into the reasons why some states are STR hot spots.

How long is a short-term rental?

In the US, the phrase short-term rental typically refers to a furnished home, apartment, or room rented for fewer than 30 consecutive days. But this definition is not exactly written into the Constitution. In the US, the short term rental definition varies from state to state – and even from city to city, within the same state. So, what counts as an STR in Connecticut might not fly in Kansas. (Figuratively, of course – thankfully there have been no more incidents of flying houses since Dorothy).

Let’s take a look at California first. This state’s short term rental definition is fairly standard, with STRs being rentals that last fewer than 30 days. However, property managers in major cities like Los Angeles and San Diego are also required to follow registration and licensing rules specific to the city. These can include strict caps on the number of rental days per year, mandatory registration and licensing, and restrictions on renting non-primary residences. So, if you’re planning to rent out that new California condo, have your paperwork ready.

San Diego’s short-term rental regulations are more California-comprehensive than California-casual. Here, STRs are categorized into tiers based on the type of rental. Hosts can choose between renting the entire property or opting for a home share, where they rent a portion while residing on-site. For either arrangement, hosts need a single STR license, they must collect transient occupancy tax (TOT), and they also need to file annual business taxes.

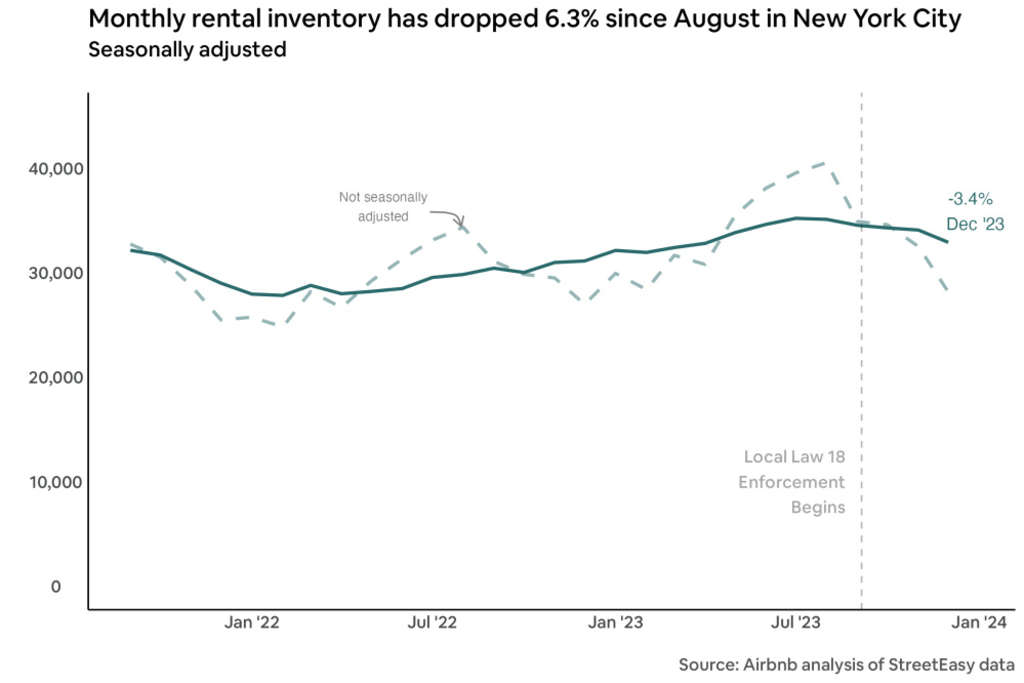

Other states, like New York, are famously strict. After a recent change in STR rules, properties in New York City cannot be rented for periods of fewer than 30 days at a time unless the host is also present at the property. That means Manhattan residents can’t fund a quick trip to the Hamptons by hosting someone in their home while they’re gone. New York’s STR rules have been contentious since they were introduced, with numerous STR hosts turning to the black market to advertise and rent their properties, and over $2.1 million in fines being doled out in 2021.

In some US cities and states, STRs can be rented for up to 31 days. Las Vegas is one of them – with some stipulations. Like in New York, STRs must be owner-occupied homes. They also can’t have more than three bedrooms, they can only be rented in certain residential zones, and they need to be licensed.

STRs vs. long-term rentals

How do STRs differ from long-term rentals (LTRs)? An LTR, as the name suggests, is a property that gets rented out for a longer period – usually more than 30 days. A single lease term might span for several months – or even years. Additionally, different sets of rules and regulations apply to how LTRs are managed.

What about revenue?

Money talks, so let’s talk money. The short-term rental market is steadily growing in the US, and that growth is expected to continue in 2025. Continued demand for unique travel experiences, as well as flexible work arrangements being more common, are both drivers for this growth.

STRs usually generate more income (per night) compared to LTRs. In 2023, average nightly rates for STRs were more than $300 in the US, whereas for LTRs, nightly income is closer to $47 to $67 on average. But other costs are involved with managing any rental property: licensing, maintenance, and tax all have to be considered too. STR income is also a little less stable. An Airbnb in a popular seaside destination might make a lot more than an LTR would in the height of summer. However, in the colder months, there may be times that an STR isn’t occupied at all. Long-term rentals provide more income stability, which can be a huge boon in an area with an unreliable market.

STRs also come with a unique set of challenges, from higher vacancy rates, to the more hands-on approach required in managing them.

Mid-term rentals sit snugly between long and short-term rentals. They tend to last for one to six months – and are often favored by traveling professionals or digital nomads. For property managers, they offer some of the flexibility of an STR, but with more stability (like an LTR).

Key considerations for property managers

You’ll know by now that there’s much more to setting up an STR than snapping a few great pics of your property and putting it on Airbnb. Before you embark on your new venture, here are some key things to keep in mind:

Licensing and registration

Most states and cities require STRs to be licensed and/or registered. You’ll remember that in Las Vegas, short-term rentals can only operate in areas zoned specifically for this purpose, and owners need to apply for licenses that must be renewed annually.

San Diego, too, has some of the most extensive regulations in the country. Hosts need to comply with rules on maximum occupancy and tax collection – as well as following specific health and safety regulations.

Denver’s Airbnb rules stipulate that hosts not only need a short-term rental business license, but their primary residence also has to be the property they are renting out. So, just like in New York and Las Vegas, if you set up an STR in Denver you’ll have to share your property with the person you’re renting to. Guest screening can make this prospect a lot less daunting, providing the added security you need to feel comfortable sharing your home with guests.

Taxes and fees

Short-term rental hosts are often required to collect and pay local taxes, including transient occupancy taxes (TOTs) – which are similar to the taxes charged to hotels. In California, for example, these can range from 8% to 15% (depending on the city). Even considering that STRs tend to yield a higher nightly income than LTRs – taxes add up. It’s crucial to factor them in when calculating your rental’s profitability.

Occupancy and safety rules

Most STR regulations include rules around maximum occupancy, fire safety, and health standards. Many cities and states also have caps on the number of tenants allowed to stay at one property and/or in one room. Here’s a snapshot of the rules in several major cities:

Los Angeles, California

- No more than two people per bedroom are allowed, plus two additional occupants per unit, following general zoning regulations.

New York City, New York

- Limit of two guests who are not related to the host. This rule applies regardless of the number of rooms available at the property.

Atlanta, Georgia

- Each bedroom can have two people staying in it. Regardless of size, the entire property cannot have more than six people staying in it at one time.

Brookline, Massachusetts

- Brookline allows a maximum of two people per bedroom, with a total occupancy limit of eight people per property. If more than three occupants are not related to the host, additional compliance with local and state codes is required.

Seattle, Washington

- Seattle allows hosts to operate STRs in up to two units: their primary residence and one additional unit. There are no specific tenant limits beyond general housing and safety codes, which typically allow for two tenants per bedroom.

Ensuring compliance with these regulations not only means you’ll avoid fines, but it also helps keep your guests safe at your property.

Where short-term rentals are booming

If you’re yet to set up an STR, and not restricted to a particular location, it makes sense to put your investment property in a location where profits look most promising.

Cities with plenty of tourism, lots of events, and great climates are typically STR hotspots. But in terms of overall short-term rental profitability, a few states stand out:

California

As one of the most visited states in the country, California is a powerhouse when it comes to STRs. From vacation homes in Malibu to Airbnbs in San Francisco, California offers a wealth of rental opportunities.

However, cities like San Francisco have been pushing back against the proliferation of STRs, implementing strict rules that hosts must follow, such as a cap on rental days per year and a requirement that every STR must be the host’s primary residence. This means that hosts must spend at least 275 nights in a calendar year living at the property. When you’re away, tenants can stay alone in the house – but only for 90 nights each calendar year.

Florida

Miami, Orlando, and the Florida Keys are STR hotspots, thanks to their year-round sunshine and tourist attractions. However, Florida has seen growing conflicts between local governments and property owners as cities try to impose tougher restrictions on STRs, in an attempt to free up housing for long-term tenants.

Nevada

Home to major conventions and non-stop tourism, Nevada has seen a massive boom in short-term rental activity in recent years. However, local governments still impose zoning laws and require STR managers to hold licenses.

Ohio

Ohio’s affordability compared to other states makes it attractive to property investors, while the attractions in Cleveland, Columbus, and Hocking Hills draw in plenty of tourists year-round.

Ohio’s STR regulations are also relatively lenient compared to some states. However, specific laws vary by municipality. In Columbus, for example, operators must apply for a license, while Cleveland requires both a permit and adherence to safety standards.

The key to a successful short-term rental

Right now, the STR business in the US promises flexibility, high demand – and potentially greater returns than from renting LTRs.

But if you want to ensure the success of your new STR – you’ll need to have a thorough understanding of local laws, taxes, and tenant management to keep everything on track and above board. Thorough means knowing what’s what: all the way from what is defined as a short term rental to what license you’ll need to run one. Make sure to keep reading, keep researching, and be sure to get advice from sources you trust throughout the process. Then, you can focus on running your business stress-free.