When it comes to protecting your property management business, every aspect of the booking journey needs some sort of safety measure in place.

A booking begins when a guest goes to process the payment for their stay at your property, and this is a prime target for fraudulent activities. The type of fraud that we are referring to is known as “friendly fraud” and is in relation to chargebacks.

Unfortunately, chargebacks are becoming more frequent in the vacation rental industry. In our post on how to prevent and manage guest chargebacks, we explained the best ways to minimize the risk of chargebacks from happening in the first place, and having 3D Secure (3DS) for payments is one of the best prevention methods you can have.

What is 3D Secure and what are the benefits?

3D Secure provides an additional layer of protection that monitors card activity and determines if a transaction needs further authentication from the card owner before it can be completed.

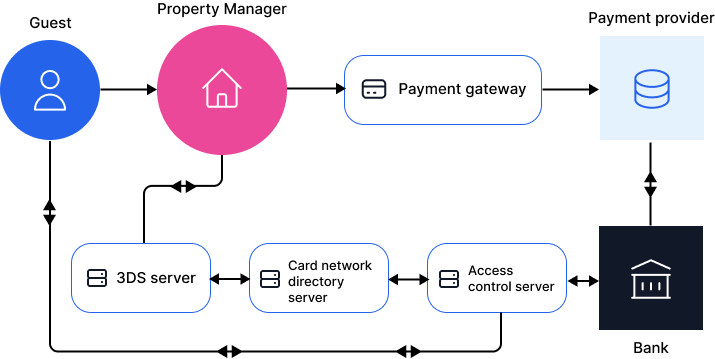

3D stands for “three domains.” The first domain is the card issuer; the second is you (the property manager) that is receiving the payment for the booking, and the third is the 3DS infrastructure that acts as a secure go-between for the guest and your business.

The use of 3DS significantly enhances security measures for both your guests and you as a vacation rental business. The benefit for guests is that they know their payment details are protected and that you are a legitimate business that takes payment security seriously.

The benefits for you as a business are that a 3DS payment transfers the liability for fraudulent activities from you (the merchant) to the card issuer/bank because they approved the transaction as legitimate.

This makes your business significantly less vulnerable to chargebacks and helps support you in building a case if a guest does request a fraudulent chargeback.

How do 3D Secure payments work?

Typically, to proceed with a 3DS payment, guests are redirected to an authentication page provided by the relevant issuing bank where they are asked to provide one of the following:

- A password they have already established with their bank for authenticating payments.

- A one-time PIN sent to their mobile phone via SMS.

- (If enabled) the fingerprint associated with logging in to their bank account.

There are a few exemptions where 3DS will not apply:

- frequent repeat payments to the same business for the same amount

- merchant-initiated payments (e.g. subscriptions)

- telephone payments

Additional payments that may be exempted from 3DS, but these are dependent on your Payment Service Provider (PSP):

- low-value transactions, for example, those under £/€30

- low-risk transactions when the Payment Service Provider (PSP) has low fraud levels across its entire platform

- corporate payments (unless the corporate card used is in the name of an individual)

How to implement 3DS as a short-term vacation rental business

Luckily for those in the vacation rental industry, most of the major Property Management Systems (PMS) have integrated with the leading Payment Service Providers, ensuring the safety and security of their users through their booking portals.

At Superhog, our philosophy is that prevention is better than cure. That’s why we’ve developed a comprehensive toolkit to help protect owners and property managers at every booking stage.

To help you secure your payments, protect your bookings, and safeguard your revenue, Superhog’s deposit & damage waiver solutions use 3D Secure to protect these payments, removing the risk of fraudulent chargebacks from guests.