Many hosts cover small guest damages out of their pockets and consider these expenses a part of the cost of running a business.

Paying for a set of linens here and a set of wine glasses there will have you out of money in no time. And it shouldn’t be that way. You can get your expenses reimbursed by collecting a damage waiver fee.

In this article, we’ll explain what damage waiver is and how it differs from damage deposits. We’ll tell you how it works and what alternatives you can use to protect your listings.

What is a damage waiver fee?

First things first. Let’s clarify the damage waiver meaning.

A damage waiver fee is a small sum hosts charge the client while renting out for short-term stays. This fee protects the guest from paying the full price of the damage.

It also creates a piggy bank for a host they can use in case of guest damage. It’s an add-on homeowners and hosts can request to waive guests’ liability for damages that happen during the rental.

The waiver is usually non-refundable and covers accidental damage. It means that if a guest accidentally damages something during their stay, they are not responsible for covering repair or replacement.

A damage waiver fee is not mandatory, and the cost varies depending on the rental company’s terms of use or the hosts’ preferences.

Damage waiver fees usually go hand in hand with STR insurance. But before you start dealing with damages, take a look at how to bring the guest damages in vacation rentals to a minimum with Rolando Mota and Daniel Tocora.

What damage waiver fee does and doesn’t cover

A vacation rental damage waiver may not cover all kinds of damages and losses or their total amount. For example, some companies don’t reimburse losses from intentional, reckless behavior or illegal activities. That’s why you should read the details of a property damage waiver policy both as a guest and as a host to know the terms of the deal.

As a rule, a vacation rental damage waiver COVERS:

- Stained linens Smeared towels

- Unintentional guest damage

- Unsolicited smoking damage

- Unapproved party damage

- Delivery expenses of replaced items

- Read what Superhog’s Damage Waiver Covers

But vacation rental damage waive DOESN’T COVER:

- Cosmetic damage

- Pet damage

- Wear and tear

- Management fees

- Maintenance expenses

- Approved party damage

- Read what Superhog’s Damage Waiver Doesn’t Cover

Even though a damage waiver fee usually provides lower coverage than insurance, it will be enough for most rental damages. Especially if you use the damage waiver by Superhog that allows you to choose where the money goes and covers almost any damage.

Nick Taylor, Managing Director of Nox, uses Superhog and shares his experience:

“Around 10% of our bookings cause some form of damage, of which, 90% can be covered by a damage waiver.”

How does a damage waiver work?

Rental damage waiver fees work pretty similarly to other kinds of waivers. As a homeowner or host, you subscribe to the damage waiver service through a rental platform. Now, you can request your guests to pay a specific fee to waive the liability for accidental property damages.

The charges guests pay depend on the rental company’s rules and property type. It may be a fixed damage waiver fee or a percentage of the total rental sum.

Once the guest buys a damage waiver, the rental platform selling it becomes responsible for reimbursing the loss.

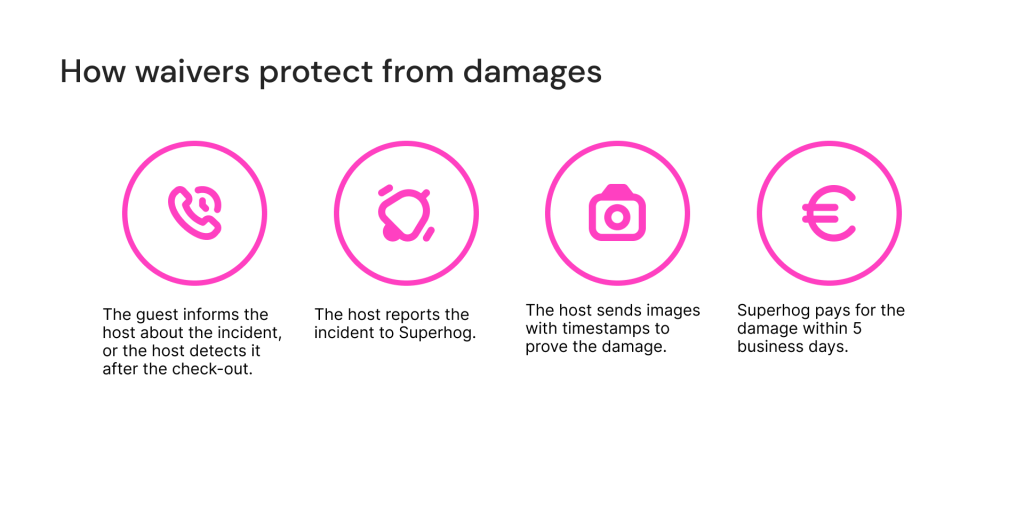

Here is how it happens with Superhog:

- The guest informs the host about the incident, or the host detects it after the check-out.

- The host reports the incident to Superhog.

- The host sends images with timestamps to prove the damage.

- Superhog pays for the damage within 5 business days.

Examples of damage waiver policies

If you want to rent properties with a damage waiver fee, you must make sure the platform you use for rentals supports them. For example, Airbnb doesn’t support a damage waiver fee for apartment rentals, and you will need to combine it with additional tools like Superhog.

Here are some popular options to collect a damage waiver fee:

- Vacasa damage waiver fee. Vasaca vacation rental management company charges guests a $15-$35/night damage waiver fee depending on the house size. The Vacasa limited damage waiver covers accidental damage up to $3,000.

- VRBO damage waiver fee. VRBO has an Accidental Damage Protection policy guests can buy 24 hours before check-in. They choose from three options: $59 for $1500 coverage, $89 for $3000, and $119 for $5000. Is the VRBO damage waiver refundable? Yes, if you ask for a refund before the scheduled arrival date.

- Superhog damage waiver fee. Superhog allows you to charge non-refundable $50 from guests, waiving damages of up to $500. Hosts keep the money and pay a 10% fee to the company for transactions.

Learn more about the Airbnb damage policy and protect your listing against damages today.

Pros and cons of using a damage waiver fee

“What business just lends a stranger hundreds of thousands or millions of dollars of assets, no questions asked?” Benjamin Earley, CEO of HOLT.

They wouldn’t. Yet, many property managers and owners do this every single day, no questions asked!

Have you ever rented a sports car for the day? That’s exactly what Benjamin’s wife did for a birthday surprise. Why is this relevant?

Simple. “The hoops she went through to get a $200k asset for 24 hours was weeks long and around 10-15 hours of work on documents, insurances, trip layouts and much more.” It’s tedious, but without it, there’d have been no Lamborghini waiting on the other side.

Property managers give expensive assets to guests every day without any risk management. That leaves them vulnerable.

Benjamin Earley explains why he uses a risk management strategy, including damage waivers, in his short-term rental business.

Having a waiver is the first step in managing risk, and if it does discourage guests, it’s likely those guests are not the type of guests you want.

Use the deterrent to your advantage because, without a damage waiver in place, you’re not just leaving yourself vulnerable to guest damages; you are leading your business down a path of out-of-pocket payouts that could ultimately result in loss of revenue.

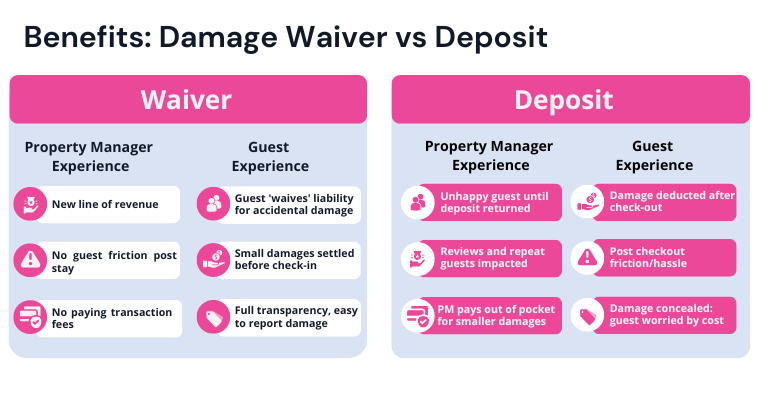

Benefits of using a damage waiver fee

Here are a few other reasons property managers implemented damage waivers fees into their booking journey workflow:

- They help you improve the guest experience. Accidents happen. We know this, you know this, and guests know this. The security of having a waiver in place can help remove any friction such as bad reviews that can arise post-stay if an accident occurs. It also puts guests at ease knowing it’s been sorted ahead of time.

- Saves time and reduces manual labor: You can diminish the time associated with handling guest-related damages, chasing guests after their stay and the hassle associated with physically collecting and refunding waivers.

- Cover minor incidents of damage quickly: You won’t need to pay out of your pocket for guest damages. Get the balance of happy guests and happy owners, while ensuring you do not foot the bill every time an accident happens.

Cons of a property damage liability waiver

Even though there are more reasons to charge a damage waiver fee than not, hosts often voice valid concerns about extra charges upsetting guests. Renting a property is costly, and extra fees on the platform can make clients unhappy and decide to look elsewhere.

Property managers may have concerns about fees going to the rental platform instead of their own pockets.

Collin H., a property manager, shares his experience:

“I went to VACASA.com and booked this cabin for January 11-14. The nightly rate is $127. The total rent is $381. But notice the “fees” that VACASA is adding on: A $45 “hot tub” fee, a $66.60 “booking fee”, and a $49 “limited damage waiver”.

Well, that’s $160 in purely junk fees, straight into VACASA’s pocket. They don’t share this revenue with the owner.”

Here are some other drawbacks of damage waivers you should consider:

- Guests must report damages and take a picture of them before leaving. Or at least the property manager must be able to prove that a specific guest has done the damage.

- Coverage may be too low to cover severe damages. Some platforms pay back $3000 maximum, which is not enough for expensive repair works.

- Many common types of damage, like intentional damage or stolen items, aren’t covered.

To avoid problems with limited damage waivers, choose a risk management tool like Know Your Guest by Superhog. This tool lets you save money for emergencies. With this platform, the sum paid for a waiver ends up in the hands of the host, who can use it to cover damage-related expenses or save for later if damage hasn’t happened.

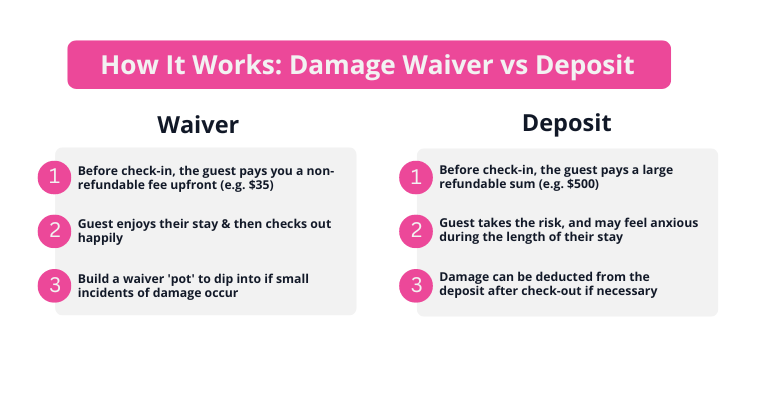

Damage waiver vs damage deposit: what is the difference?

Now that you know what is a waiver fee for apartments, it’s time to talk about damage waiver fee alternatives. Damage waivers and deposits protect hosts from vacation property damage in different ways. Hosts often use them together.

But what is the difference, and how do you know which one best suits your short-term rental business?

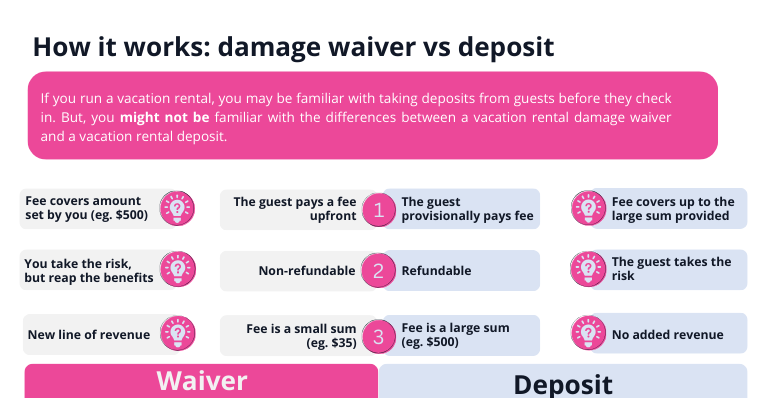

Damage waiver vs damage deposit: the principal difference between them is that a damage waiver is a smaller, one-time, non-refundable fee. Large STR companies often opt for damage waivers because they are fast, generate revenue, and reduce conflicts with guests over damaged items.

With a damage deposit, guests pay a certain amount during the booking process, which is held until check-out. Smaller short-term rental business owners often prefer damage deposits. They cover all types of damages up to a limit, offering a sense of security, helping ensure guests respect the property, and giving greater leverage if something happens.

However, many property managers are moving away from the traditional damage deposit in favor of damage waivers. Many guests find it inconvenient to pay a large amount of money upfront and would instead, book with a competitor who doesn’t require a damage deposit.

Damage Waiver VS Damage Deposits: How it Works

Do you need a damage waiver or a damage deposit?

Let’s decide what will serve your needs in the best way: a damage waiver vs a damage deposit. First, weigh out the pros and cons for your business to protect your property while still enticing guests. Here are some questions to consider:

- Think about the standard of your property: is it providing a luxury stay? Adjust your deposit or damage waiver to reflect this. If you’re concerned about potential damages, you can add damage protection to cover any harm your properties might face.

- Who is your target guest? Do they have the means to provide large deposits, or would they benefit from a damage waiver?

- Think about your turnaround time: is it quick, or do you have periods between guests checking out and new guests checking in? Having a waiver pot available for quick turnarounds would help cover damages. Longer turnarounds allow for disputes over damage deductions from a deposit.

Collect damage waiver fee with Superhog

Every booking will incur some sort of damage: whether it be suitcase marks on the wall or broken glasses, all these little extras add up and there is no point in trying to claim it from a deposit. The hassle isn’t worth it.

With a damage waiver, every guest pays you a non-refundable $50 to waive damages of up to $500. If only one in ten bookings results in damages to the cost of $150, you would cover the cost of repairs and still have an extra $300* as either a profit or a pot that builds up in case of an emergency.

Not only does it benefit you, but you protect your guests from paying more for their stay than they had budgeted while eliminating disagreements with guests about whether or not they should be held responsible for certain damages.

Want to know more about how a Know Your Guest damage waiver can improve your efficiency and cash flow? Speak to us today!