A guest has left your property after a good vacation. Now, you are preparing it for the next reservation.

Suddenly, you get a notification from your phone. You think: “Great! That guest who left 2 days ago must have left a review!”

Instead of feeling proud from a 5-star review, you find out the guest wants a chargeback. So the money for their booking is gone from your account and your bank is actually charging YOU a penalty charge.

Unfortunately, chargebacks are on the rise. Chargebacks911 estimates that they are increasing at a rate of 20% per year, and with businesses on average only winning 32% of chargeback disputes, vacation rental managers and hosts must have protective measures in place. That’s why anyone renting out must properly understand vacation rental chargeback rights and know how to prevent and handle them.

What is a chargeback aka “friendly fraud” in vacation rental?

A chargeback is when a guest tells their bank that a payment for a vacation rental on their card was wrong or a scam. The bank takes the money back from the property manager or host and gives it back to the guest after checking the vacation rental chargeback process.

Anyone who uses a credit card to purchase anything online can request a chargeback, as they are designed to help customers feel secure and prevent fraud.

Yet, not all chargebacks are bad. The difference lies in the intention of the guest.

| Scam chargebacks | Non-scam chargebacks |

| Unauthorized transactions: This happens when a guest says they didn’t approve or make the payment. | Disputed transactions: This is when a guest admits they made the payment but disagrees with it for reasons like the wrong amount. |

| Stolen credit cards: A chargeback can be made if someone used a stolen credit card to pay. | Service dissatisfaction: If a guest feels they didn’t get what they paid for, they might ask for a chargeback. |

| Attempted fraud: A guest might try to avoid paying by falsely saying the payment was a scam. | Cancellation disputes: A guest might agree to a cancellation policy when booking but later cancel and try to get a full refund through a chargeback, arguing about the fees or wanting part of their money back. |

Why do guests request vacation rental chargebacks?

Guests might request vacation rental chargebacks for any number of reasons, both legitimate and fraudulent, including vacation rental scams. For instance, VRBO chargebacks are a widely discussed issue.

Here are some of the most common reasons for guest chargebacks:

1. The house didn’t match the description

People usually request chargebacks if they feel they did not get exactly what they paid for.

If amenities that were promised were not available, the property was not cleaned before arrival, or the property was not represented accurately on a booking platform or your own direct booking website, then a guest might request a chargeback on the basis that they did not receive the product they purchased.

2. The guest changes the length of stay

Suppose a guest couldn’t stay at the property altogether or had to leave early because of an issue with the property. In that case, they may request a chargeback because again they did not receive the product they purchased – i.e. a stay at your rental for the requested number of days.

Even if you agree to refund the guest for those unstayed nights, you may see a chargeback for the full amount of the stay.

Vacation rental chargebacks will always relate to the full booking amount, with fraudulent guests looking to take even more money from you in this case.

3. Intentional and friendly scams

Scams are one of, if not the most difficult claims to refute, and will be the most surprising to you as an owner.

The person staying in your rental might not be the person whose card was charged. If the card is stolen, the cardholder will request a chargeback and because the card is stolen, the request will more often than not be upheld. It’s usually pointless to dispute these types of chargebacks – fraud cases are almost invariably settled in favour of the cardholder.

However, with friendly fraud a cardholder will attempt to claim the use of their card was fraudulent when they did, in fact, make the booking and stayed in the property.

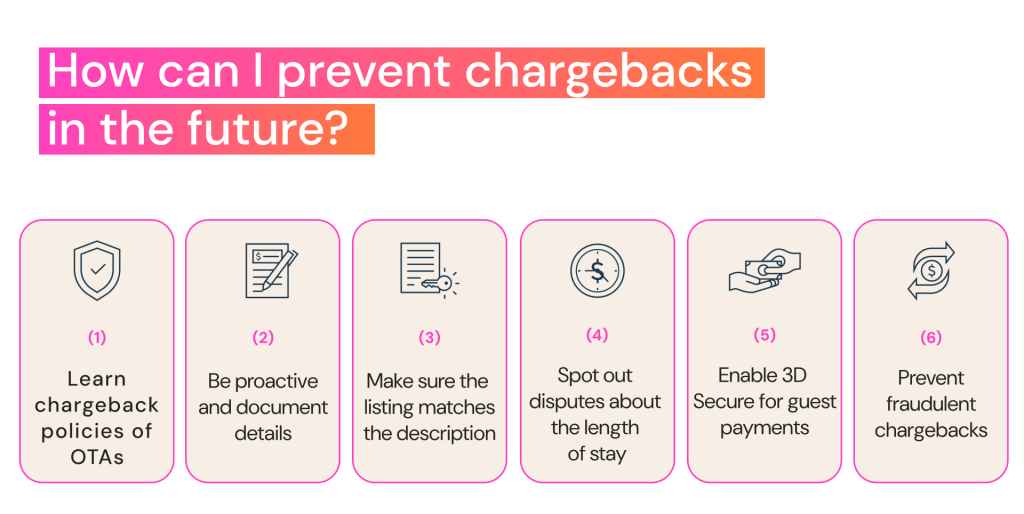

How can I prevent chargebacks in the future?

It takes from 6 weeks to 3 months to resolve a chargeback. For obvious reasons, you want to avoid the issue in the first place entirely. What steps can you take to protect yourself against chargebacks?

1. Learn vacation rental chargeback policies

Though no one likes thinking about losing their money even before getting them, it’s better to know the pitfalls. They are a regular part of the rental business.

Go to the website of the company you use for renting your vacation properties and read how they deal with chargebacks for vacation rental owners. Chances are, they cannot do much when a client disputes their charge with a credit card company, but some help is still possible.

Airbnb, for example, directly states on its website that once the chargeback is filed, the company cannot resolve the dispute with hosts directly, and a refund will come from the bank.

LeAnne221, an Airbnb host, has faced such a problem:

“When a guest disputes their charge, Airbnb cancels the booking, claiming that it is fraudulent. They do not dispute chargebacks, so the guest wins and the only person paying is the host. I am SO incredibly frustrated as this just happened to me and I have been attempting to work with Airbnb for 30 days now! I receive the same copy and pasted information from them over and over again.”

VRBO’s chargeback policy is similar to Airbnb’s. They have a fraud-detection engine to reduce fraudulent transactions and help with disputing chargebacks but can do nothing if the credit card company reverses the charge.

The lack of proper support is bad news. Yet it also means you should rely on yourself and be more careful while screening guests to ensure chargeback prevention for vacation rental hosts. Tools like Know Your Guest, a risk management platform for property managers, can help you with ID verification and collecting deposits and waivers that can prove your guest is ready to pay.

2. Be proactive and document details

Written proof will give you the upper hand in disputes with the unsatisfied guest, rental platform, and credit card company.

Getting a chargeback for Airbnb is not always about fraud, so don’t rush to hate the guest. They may have a valid reason to ask for a refund (or at least be super convinced they have it).

That’s why one of the easiest ways to prevent vacation rental chargebacks is staying in touch with your guests from the first moment on. Try to be understanding and find ways to solve their concerns.

It may help you avoid escalating the conflict to the point of disputing vacation rental chargebacks.

Another helpful tip is documenting every detail of your conversations and using the rental platform for messaging.

3. Make sure the listing matches the description

If a guest claims that your property is not the same as the one you are advertising, then you might need to see if they have a valid point.

Do your photos need updating to reflect recent changes? Are there any amenities that need updating? Do you need a more regular maintenance schedule for your vacation rental to ensure your amenities don’t break down during the stay?

Make sure your description reflects listing it accurately, with high-quality photos that truly reflect your property, commit to regular maintenance checks, and hire a reliable cleaning service you know you can always count on to do their best work.

Fraudulent listings on the major booking platforms are also on the rise and something that owners need to be wary of. Superhog allows owners to demonstrate their credibility and authenticity, by acting as an independent third party that verifies your property is real and proves to guests that you are trustworthy, and most importantly, that the property is legitimate.

4. Spot out disputes about the length of stay

If a guest can’t stay at your property and requests a refund, be sure to have an issue resolution strategy and make your cancellation policy and terms of service clear from the start.

This will help manage guest’s expectations about the refund . Also, the guest won’t feel that a chargeback is the only option.

Guests who dispute the number of days they stayed without informing you, or who claimed they didn’t stay at the property at all when you know they did, aren’t situations you can avoid by any other means than having comprehensive guest screening.

Superhog’s advanced guest screening integrates seamlessly into the pre/post-booking journey, giving owners and hosts the ability to verify their guests through a combination of ID verification and Biometric checks.

5. Enable 3D Secure for guest payments

One of the best preventative measures for vacation rental chargebacks is 3D Secure. It provides an additional layer of protection that monitors card activity and determines if a transaction needs further authentication from the card owner before it can be completed.

For property managers who use a Payment Service Provider like Stripe or Worldpay, 3D secure links are easy to implement. For more information about the benefits of 3D secure, check out our blog on the importance of 3D secure payments for vacation rentals.

6. Prevent fraudulent chargebacks

Avoiding fraudulent chargebacks is complicated, but not impossible.

To protect your rentals, you’ll need to take some pre-emptive steps to verify the person you’re dealing with is who they say they are. Superhog can automate this process for you and is integrated with the largest property management systems in the industry.

Learn more about Superhog’s PMS integrations.

While chargebacks can be a real kick in the teeth, they are a normal part of doing business for any industry that accepts credit cards. Tackling chargebacks is one of the more difficult parts of vacation rental ownership, but what if you didn’t have to handle it all by yourself?

Our deposit/damage waiver solution uses 3D Secure to ensure that you’re protected from fraudulent chargeback requests and can cover any accidental damage that occurs during a guest’s stay.

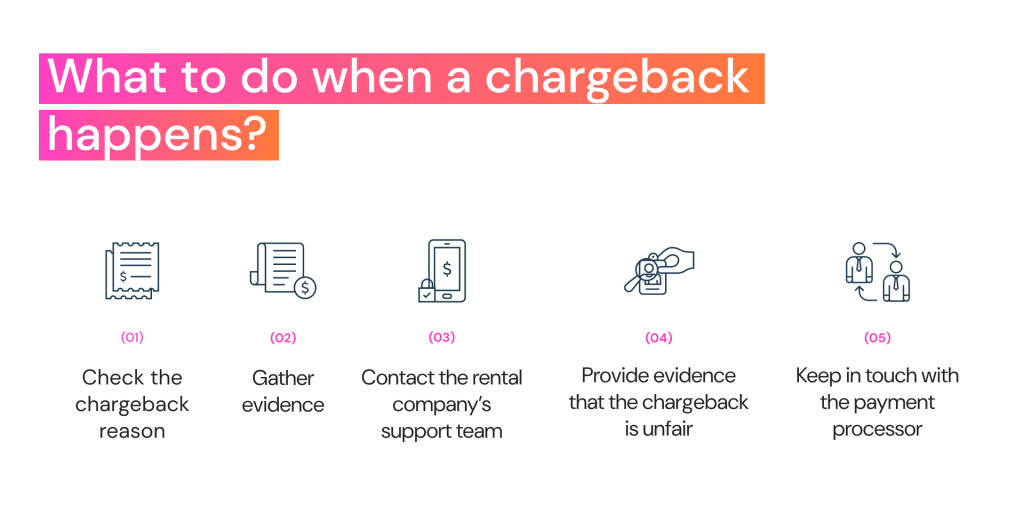

What to do when a chargeback happens?

Imagine the worst has happened, and an unhappy customer or a scammer has filed a dispute. If, after contacting them, you realise nothing can be done to resolve it amicably, follow the next steps to resolve a vacation rental chargeback:

- Check dispute details to learn more about the reason and decide on the strategy to prove you are right.

- Gather evidence that shows you have provided quality service on the agreed terms (e.g., transactions, communications, or guest agreements)

- Contact the rental company’s support team to clarify how they can help you solve the dispute. They may help you gather documentation to support your case.

- Respond to the payment processor and provide them with evidence that the guest’s request is unfair or fraudulent.

- Keep in touch with the payment processor and send them all the requested information to make the desired outcome more likely to happen.

Even though the credit card company may still resolve the dispute in the guests’ favour, these steps considerably improve the chances of winning. So just follow the process and do everything that depends on you to prove your innocence.

Best practices for handling vacation rental chargebacks

These chargeback best practices for vacation rental businesses should help you quickly take action when all precautions have failed, and a guest files a chargeback.

So if the worst has happened, you should:

- If you are using Superhog guest screening, you share a signed guest agreement and the screening result that proves the date and completion of the booking with the platform.

- Respond to the chargeback request promptly and professionally.

- Refer to your booking terms and conditions if the guest has violated them and inform the guest about the violation.

- Gather all related documents and save the screenshots of communications with the guest.

- Stay patient while communicating with the guest, rental platform, and credit card issues since the dispute resolution may last for months.

Be prepared for the long haul. Once a guest files a chargeback, settling it can take up to 90 takes. While the chargeback process occurs, the bank will likely deposit the disputed payment into your account, but may later take it back, if you lose the dispute.

Finally, you must learn from every case of vacation rental chargebacks to strengthen your booking policy and pick guests more carefully. It is way easier when you use Superhog guest screening and ID verification for vacation rental chargeback prevention.

Superhog provides Know Your Guest tool for property managers with guest screening, ID capture, property damage deposit, and other helpful risk-management features. With this tool, you get a deeper guest screening to prevent fraud. On the other hand, Superhog makes your property look more reliable to potential guests by acting as a third-party that verifies your property. It’s a win-win case and, most importantly, a way to minimise vacation rental chargebacks.

FAQs

Tips to prevent chargebacks:

1. Set up and follow your House Rules and Cancellation Policy: Be clear about your rules and stick to your refund and cancellation policies.

2. Provide accurate property details: Give a true description of the property, list of amenities, and recent photos.

3. Be proactive and responsive: Quickly address any guest concerns before they become bigger problems.

4. Document conversations: Keep all communication in writing using our secure messaging platform. 5. Confirm all policies, agreements, and any refunds in writing.

6. Issue refunds correctly: Use our platform to give refunds in the same way the guest paid. If you must refund outside the platform, document it through our secure messaging system.

A chargeback is when a guest asks their bank to reverse a payment for a vacation rental because they believe the charge was incorrect or fraudulent.

1. Review the chargeback details to understand the reason.

2. Gather evidence that shows you provided the service as agreed.

3. Contact the rental platform’s support team for assistance.

4. Respond to the payment processor with the necessary evidence.

5. Stay in touch with the payment processor and provide all requested information.

Resolving a chargeback can take anywhere from 6 weeks to 3 months, depending on the complexity of the case and the responsiveness of all parties involved.

1. Keep detailed records of all transactions and communications.

2. Provide clear and accurate property descriptions.

3. Address guest concerns promptly to prevent disputes from escalating.

4. Use a secure messaging platform to document all agreements and refunds.