They say there’s no use crying over spilled milk, but with vacation rental damage averaging over $2,000 per incident, it’s understandable if property managers get upset about damage.

Damage protection is essential when renting on Vrbo or any online platform, but navigating waivers, deposits, policies, and insurance can be tricky. Which option is best? How do you communicate it to guests?

So in this post, we’ll cover Vrbo damage protection, its benefits, limitations, and how to choose the right coverage. We’ll also guide you on setting it up, effectively communicating policies to guests, preventing damage, and exploring alternatives as your business grows.

For real peace of mind and effective protection for your Vrbo rentals. Let’s get started.

What is Vrbo damage protection?

Vrbo damage protection is a program by the leading vacation rental platform Vrbo, termed Accidental Damage Protection. It is a form of insurance or damage waiver fee for guests, providing them with coverage during their rental stay in case of guest damage.

It can cover the guests’ costs if they accidentally cause damage to the property, so the host can quickly pay for the repair.

It is provided through the insurance firm Generali Global Assistance.

There are three tiers of cover:

- $59 for coverage up to $1,500

- $89 for coverage up to $3,000

- $119 for coverage up to $5,000

This protection for guest damage on vacation can be voluntary, or hosts can require guests to purchase a certain level when they book. Hosts have 14 days after the guests check out to file a claim.

Why use Vrbo’s damage protection?

Vrbo’s host damage protection policy provides:

- Added peace of mind for both guests and the hosts. It means that if any damage occurs, the host will be able to pay for it, and charge the guest in turn. The insurance will cover these costs, and no-one will be left out of pocket.

- Reduced need for confrontation and/or potential conflict. Damage protection means the delicate topics of money and damage are figured out in advance, reducing the risk of hosts angering guests by bringing up the topic of damage, money, and compensation if necessary later. This means less stress for you and the guests, and a higher chance of a positive review.

- Protection for your business. With prompt insurance available in the event of damage, you can quickly access funds to make any repairs, reducing the risk of downtime and loss of income.

- Reduces the risk of damage overall. Asking guests to pay for damage protection raises their awareness that there are house rules and that there are consequences for damage. This manages guest expectations, attracts respectful guests, and encourages them to take good care of the property during their stay in the first place. (See below for more tips on how to prevent damage).

- Reassurance for property owners. If your rental business relies on property owners, requiring guests to take out damage protection offers an extra level of reassurance, as owners know that you are keen to avoid damage, and will repair anything quickly if it does happen. This is another way to show prospective owners that you are a responsible and trustworthy property manager, further convincing them to join your rental portfolio.

A third party policy can take this even further than Vrbo’s damage insurance programs. As Cody Wood, COO of STR Accommodations in the USA and a Superhog user, explains: “I use Superhog to stand out and win over new investors and homeowners.”

“Damages are the nature of this business. They’re going to happen. [We want to] make sure damage costs aren’t coming out of our pocket, or the homeowners’ pockets. We also wanted guests to take care of the properties,” he explains, about the importance of damage protection.

Types of Vrbo damage protection

Vrbo offers three kinds of property damage protection as part of its booking process.

- Vrbo Accidental Damage Protection

- Vrbo Damage Deposit

- A card on file through Vrbo

Accidental Damage Protection vs Damage Deposit: A comparison

| Vrbo Accidental Damage Protection | Vrbo Refundable Damage Deposit | Card on file | |

| Amount set by the host | ✅ | ✅ | ✅ (The host can charge a chosen amount) |

| Refundable | ❌ | ✅ (If no damage reported) | ✅ (Not charged if no damage reported) |

| Host deadline to claim | 14 days after check-out | 14 days after check-out | 14 days after check-out |

| Maximum cost | $119 for coverage up to $5,000 of damage. | Typically $200-500, but hosts are free to ask for more if they wish. | No limit, but the host must verify their claim with proof/documentation. |

However, some of the limitations of Vrbo’s damage insurance offerings include:

- You only have 14 days after a guest has checked out to make a claim on either option

- If you have not asked for a damage deposit or Accidental Damage Protection for a particular stay at the time of booking, you cannot add it after a guest has booked, during their stay, or retrospectively claim. Accidental Damage Protection must be bought at least 24 before check-in.

A Vrbo security deposit is likely the preferred option for careful guests (as they will get their payment refunded), while the Accidental Damage Protection will likely be the best option from a host’s perspective (as they do not have to refund the payment).

However, a third party policy — such as via a company like Superhog — is even better for hosts, as you do not need to ask guests to take out a separate policy for each new booking, will be covered more comprehensively, and will be able to claim for damage even if there is no coverage on Vrbo itself.

Can a host ask for a Vrbo damage deposit and insurance?

No, not within Vrbo itself. Hosts can only ask for one of three kinds of accidental damage protection on Vrbo per listing and booking, not two or three at the same time. These are:

- A card on file, which the host can charge in the event of damage. They do not see the card information, and they must submit a claim within 14 days of the guest checking out to use it.

- Accidental Damage Protection. One of three pricing and coverage tiers. Non-refundable, even if there is no damage during the stay.

- Damage deposit. As much as they choose. Full refundable if no claim is submitted within 14 days of the guest checking out.

The only way that a host can leverage a damage deposit and extra insurance protection would be to ask for a damage deposit through Vrbo, and cover their rental properties with a third-party damage deposit platform that is separate from Vrbo, such as Superhog.

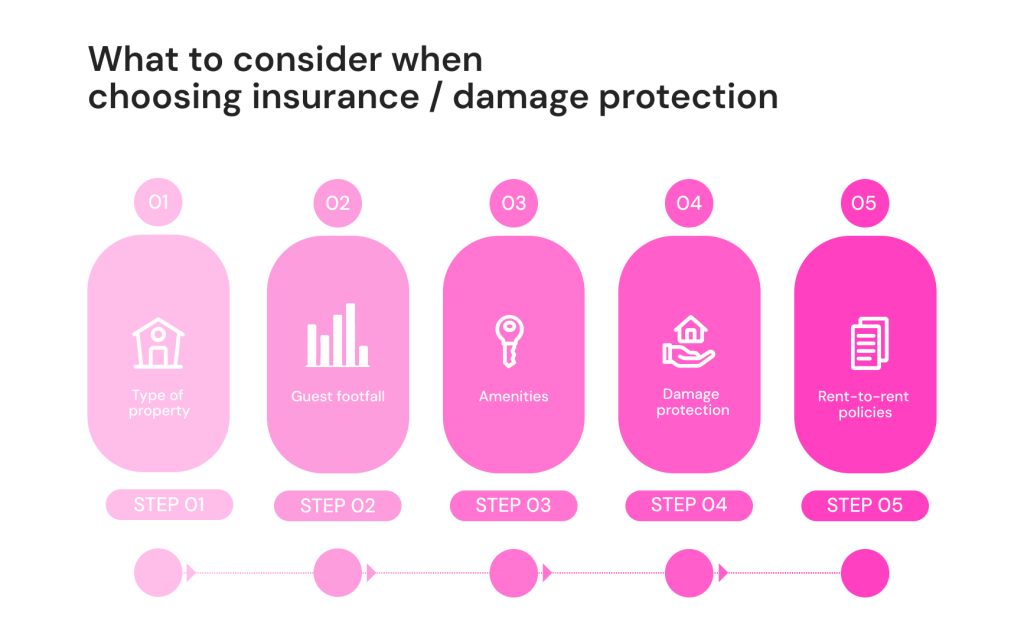

Tips for choosing the right protection level

The “right” level of Vrbo damage protection for your property will depend significantly on factors such as:

- The level of risk you (or the property owners) are comfortable with

- The guests booking (e.g. guests with children and pets, vs a solo traveler with good reviews)

- How much guests are paying overall for their stay

- The value of items in the property

- The amount it would cost you to repair damage

Vrbo has three tiers: $59, $89, and $119; for coverage of $1,500, $3,000, and $5,000 respectively. As for damage deposits, Vrbo estimates that most are around $200-500, but again, it will vary considerably depending on the level of risk, the percentage of the overall stay price, and the type of guests.

In some cases, it may be clear which tier or amount will correspond best to your guests and property. In others, it may be a little trickier to get the balance right.

How to set up damage protection on Vrbo

Vrbo provides step-by-step instructions on how to set up your damage protection policies on your listings via its help pages.

It states:

You can require guests to either purchase property damage protection, or pay for damages if they occur.

- Log in to your account.

- Select the listing you want to edit.

- Select Calendar from the navigation menu.

- Select Settings, then select Damage protection.

- Select either Property damage protection or Damage deposit.

- If you select Property damage protection, choose a coverage amount to offer your guests.

- If you select Damage deposit, enter the amount you require.

- Select Save.

How do I file a damage claim on Vrbo?

If you wish to file a damage claim for damage caused during a stay, you must firstly:

- Do this within 14 days of the guest checking in

- Take photos of the damage as proof

- Keep all documentation, photos, receipts or other records of the damage and the cost of repair

Then, log in to Vrbo’s “e-claims portal”, which is jointly run by Vrbo and its insurance provider, Generali. You must use your email address registered on your Vrbo host account to do this.

You can also contact Vrbo’s claims department by phone or email.

Once you have successfully made a claim through the portal or with Vrbo directly, you will be assigned a case manager who will coordinate the claims process with you.

Does Vrbo chase the guest for the payment?

No. If the guests paid for an Accidental Damage Protection policy (any tier), or paid a damage deposit, Vrbo will not chase the guest for any costs.

In the first case, the insurance company will pay out to the maximum coverage; in the second case, you will be reimbursed the amount from the damage deposit, to the maximum paid.

In a possible third case, the credit card on file (if applicable) will be charged. The host does not see the credit card details; these are held “in escrow” by Vrbo, and only used if or when the host makes a claim.

Any extra repair costs beyond the protection policy or deposit limits will not be covered through Vrbo. However, if you have third party damage protection, such as through Superhog, you can claim there too.

It’s easy to submit a claim through Superhog; simply log in to your account, go to the Resolutions tab, and submit your claim there, ideally with photos as proof. The in-house team will take it from there.

How should I communicate with guests about damages?

The best way to deal with damage in your property is to be as upfront as possible with guests, hopefully building on the strong foundation of expectations about damage and House Rules set from the start (see the next section for tips on how to do this).

You may want to send this to them in a pre-arrival email, and/or include it in your house rules (whether you send these digitally, or have them in a hard-copy booklet in the property itself).

“With guests, be as kind as possible from the very first contact to when they leave. Even if things go wrong, if you have the right attitude, they’ll come back,” says Saskia van der Bolt, a property manager in Italy and a Superhog user.

Here are some best practices on how to communicate with guests about your damage policy, before their stay, and in the event that damage does happen, and you need to claim.

Explain to your guests what a damage deposit is and how it works

This is good practice because explaining this thoroughly will mean they are more likely to pay it happily, as they will understand why they are paying it, and the issues it can avoid in the future.

Communicating to guests as early as possible can reduce resistance to any extra steps, such as deposit payments or background screening. As Cody Wood explains: “We tell them upfront [about our screening process]. So it’s not a huge inconvenience for them.”

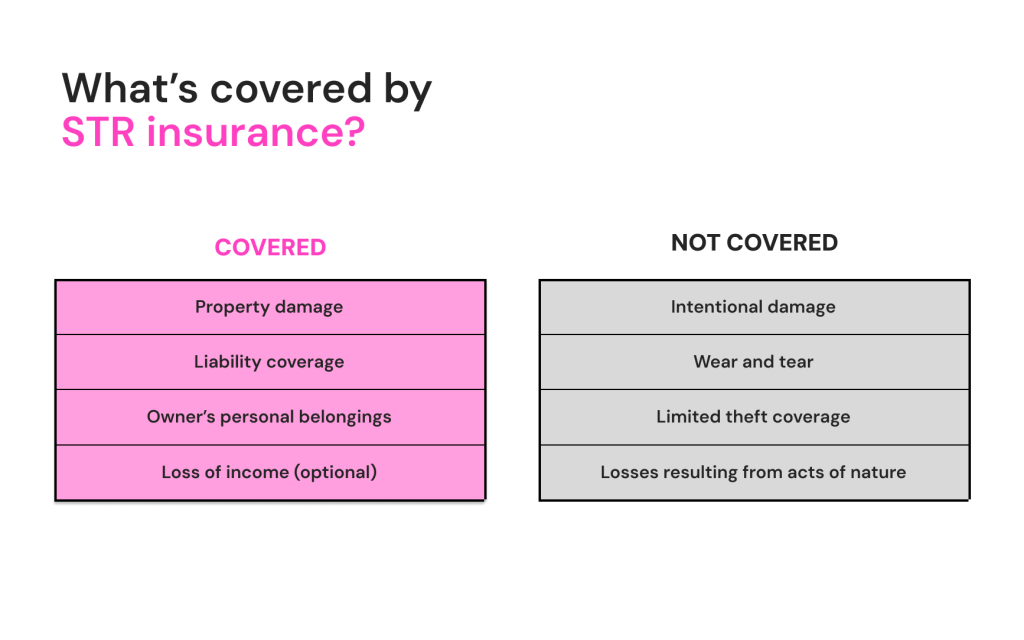

Be clear on the damage that is (and is not) covered by Vrbo Damage Protection

The vast majority of guests do not want to cause damage, and will be actively working to prevent it (for example, being careful with glassware, cleaning their dog’s paws, or clearing up spilled food).

Giving guests clear examples of the kind of damage that is covered by Vrbo Damage Protection, and what is not, will help them understand the type of policy it is, and remind them of their obligations as a guest.

As a reminder, Vrbo Damage Protection covers:

- Accidental, unintentional damage by any one of the guests (including pets listed on the booking).

- Theft or damage by someone other than the guests on the booking, if a police report is filed.

Vrbo policies do not include:

- Intentional damage by any of the guests or their companions.

- Regular cleaning fees or deep cleaning.

- Intentional theft by any of the guests. It does cover theft by a third party (not any of the guests), if there is a police report of the theft.

- Pet damage, if the pet was not included in the booking and agreed with the host in advance.

Let them know the process if they accidentally damage something

Explaining this can remove the awkwardness of any possible future confrontation, as you have already been clear about the process and policy.

For example, explain that you will check the property after they leave for any signs of damage, and that you must submit a claim within 14 days. Explain that you understand the difference between actual damage, and normal wear and tear, and will provide proof if you need to submit a claim (this is good practice). You can also explain how you submit a claim via Vrbo, and how it works.

If there is any confusion or dispute, you can refer them back to the process you originally explained.

Good guests will also feel reassured by your attention to detail, clear expectations, and the responsible planning about what will happen if there is damage or an accident.

“We have a lot of repeat business from guests who trust us to offer a safe place to stay,” says Saskia.

Be clear about how much of their deposit will be returned if no damage occurs

Let guests know if their policy is refundable (e.g. damage deposit vs Accidental Damage Protection), and let them know when they can expect to get this back if no damage occurs (after 14 days).

After all, they are handing over money, so it’s appropriate to let them know when they’ll get it back.

Are guests notified if hosts make a claim against them?

Guests are not notified if there is a damage claim made for their stay if they paid for the Accidental Damage Protection policy, as this is non-refundable.

Guests will be notified about a damage claim against them if:

- Their card is charged (if they had a credit card on file for the booking).

- They do not receive their full deposit back after the 14-day limit

They can dispute the charge, but only if they can provide substantial evidence that they have a case.

Can guests choose not to purchase Accidental Damage Protection?

Yes, but it depends on the host’s policy.

The guest must purchase it — or pay a damage deposit — if the host requires it at the time of booking. However, the guest can choose not to pay a deposit or take out the Accidental Damage Protection if the host does not require it.

However, this is not recommended, as it leaves both parties liable to possibly substantial costs and confrontation if damage does occur, and if neither the host nor guest has third party insurance.

This is another reason to have a third party policy with a company such as Superhog, as you are protected even if Vrbo’s policy or booking doesn’t cover the damage.

Tips for preventing property damage

Of course, the best way to protect your Vrbo from damage is to prevent it in the first place.

Here are some tips:

Craft listings that attract your ideal guests

Writing descriptions and using photos that are designed to appeal to your ideal guests will repel guests who aren’t suitable for your properties.

For example:

- If you want young professionals rather than families, emphasize your close location to public transportation, or cool bars.

- If you want quiet couples, highlight your remote setting, and show photos of your cozy decor.

- If you want small families rather than partiers, show your family games collection and baby highchair in the kitchen.

Price your rentals accordingly too, to avoid guests whose only priority is a quick and dirty bargain, or people who will quibble on every penny. Similarly, summarize your house rules in your listing, and be clear that guests are required to agree to them when booking.

You’ll be more likely to attract good-quality, respectful guests (and deter others) this way.

Screen guests and/or ask questions before or after booking

It’s your property after all, and you’re allowed to ask who will be staying there. Strike up a conversation via messenger with guests, ask them the reason for their stay, and if they’re happy to accept the rules.

Respectful guests will be happy to answer your questions and see your interest as a sign of professionalism and responsibility.

Disrespectful guests or those with poor intentions may be deterred and cancel their booking, thereby preventing damage before it even has a chance to happen.

A platform such as Superhog can screen guests for you automatically, in a much more comprehensive way than offered via the Vrbo platform, and with far less confrontation or disruption to your guests’ booking experience.

This can identify bad guests before they even arrive, and reduce the risk of scammer or fraudulent practices like premeditated vacation rental chargebacks.

Communicate your house rules and policies repeatedly

Even good guests are busy, so it makes sense to list your rules clearly, and share them repeatedly.

In 2023, the Superhog vacation rental dispute resolution team processed 977 reports of damage in client properties, but Senior Resolutions Advisor Tanya Simmonds is clear that only damage agreed in the policy in advance can be covered.

For example, this includes damage to towels from fake tan and makeup (the most commonly-reported issue in 2023), and smoking indoors; but not damage caused by pets included on the booking.

You can’t ask guests to stick to the rules if they don’t know about them! So be sure to include your rules (such as no smoking indoors, no extra guests, and no pets) in your confirmation email, your pre-arrival message, your check-in welcome guide, and your post-check-out thank you note.

That way, guests will always know what is expected of them, and what will happen if damage occurs. They can’t claim they didn’t see it, they will take more care, and are less likely to dispute a claim.

Are there alternatives to Vrbo damage protection?

Yes. Vrbo’s damage protection policies are not the only way to protect your Vrbo properties.

In fact, some property managers would argue that proprietary platform policies — such as Airbnb damage policy Air Cover or Vrbo’s Accidental Damage Protection — do not go far enough to protect your rentals.

Similarly, Vrbo (and other OTA insurance options) won’t work if you’re looking to expand your business beyond the platforms, and/or increase your profit by boosting direct bookings.

As Cody Wood explains: “That was homeowners’ biggest concern with direct bookings: to offer safety and security policies. To be able to do that was a game changer. It has allowed us to build confidence…and move guests away from the platforms and into direct bookings.”

If you’re wanting an alternative to Vrbo’s options — either because you feel they are not comprehensive or convenient enough, you want more direct bookings, or because you don’t like charging your guests for deposits or policies via the platform — an alternative like Superhog could be a better solution.

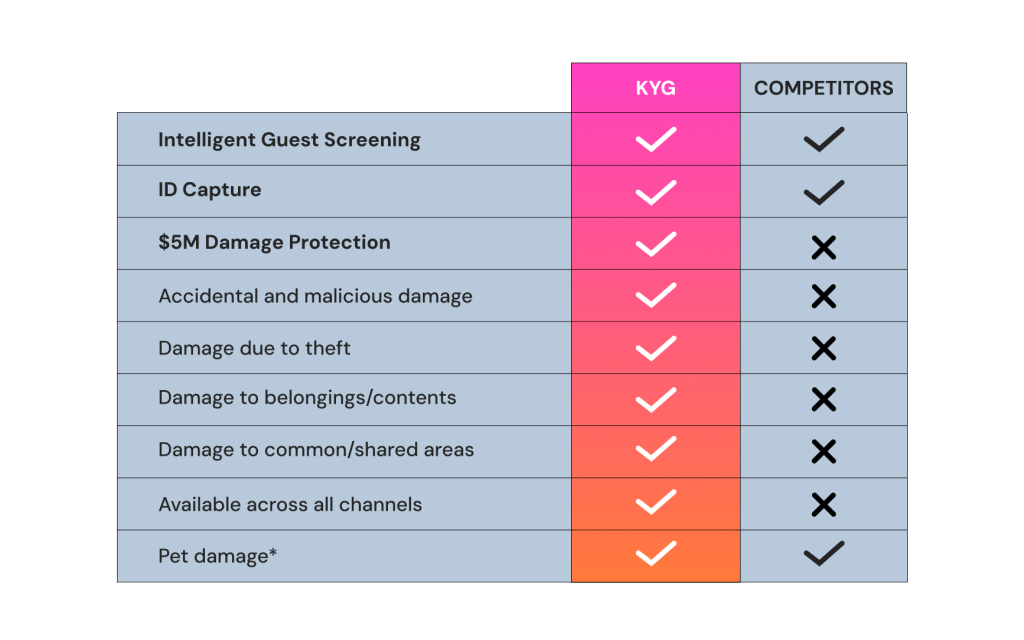

Superhog’s comprehensive solution offers damage protection and much more than the coverage included by Vrbo (or even Airbnb).

| Vrbo | Superhog | |

| Takes a damage deposit/ damage waiver | ✅ | ✅ |

| Damage Protection Plan covers up to $5,000,000 | ❌ | ✅ |

| Covers malicious damage as well as accidental damage | ❌ | ✅ |

| Automated / assisted management of claims | ❌ | ✅ |

| Comprehensive screening to identify bad guests early on | ❌ | ✅ |

| Works for direct bookings or bookings not on Vrbo | ❌ | ✅ |

| Detects signs of fraud, stolen cards, or scam chargebacks | ❌ | ✅ |

| Captures ID and verifies guests in a smooth process | ❌ | ✅ |

Vrbo properties: How to maximize your damage protection

There’s no doubt that Vrbo damage protection offers some element of peace of mind when renting out your properties, and can help you cover the costs of inevitable accidental damage.

So if you’re thinking if Vrbo damage protection is worth it — the answer is, yes…it’s better than nothing.

But asking for a vacation rental security deposit, damage waiver, and/or damage protection plan through a third party company like Superhog is likely to be far more suitable for the needs of a serious property manager.

Not only does it cover you far more (up to $5,000,000!), it also works for bookings taken through all OTAs or directly (a win for your bottom line), as well as making it much easier to handle a claim via the in-house dedicated team.

Plus, it covers malicious damage as well as accidental (so you can prevent parties, or clear up after one…), and can help you stop trouble before it even arrives, with the help of tools like background screening, fraud and scam detection, vacation rental chargebacks prevention, and ID verification.

And all this, without adding friction and obstacles to the guest journey, ensuring you have maximum peace of mind for you, your owners, and properties — and minimum stress to the guest experience.

“We are a hospitality company with a hospitality mindset; we don’t want to be chasing guests for money,” says Cody Wood, echoing the thoughts of dedicated property managers everywhere.

“We want guests to have a great experience…without us having to go after them for small damages. Superhog handles it for us.”

Vrbo damage protection: FAQs

A Vrbo vacation rental security deposit is set by the host (in terms of the amount), refundable if the host does not make a claim within 14 days of the guest checking out, and varies in cost depending on the host. It typically ranges from $200 to $500 per booking, but can be much more if the host demands it.

Vrbo’s Accidental Damage Protection is also requested by the host, but is available in three preset tiers of coverage ($59, $89, and $119; for coverage of $1,500, $3,000, and $5,000 respectively). Hosts also have 14 days after the guest checks out to claim, but it is non-refundable even if there is no damage.

A security deposit is likely the preferred option for careful guests, while Accidental Damage Protection will likely be the best option from a host’s perspective.

Vrbo’s policy states that any damage that exceeds their policy limit will be liable to be paid for by the host, who by extension, can ask the guest to pay up. This is a major limitation of Vrbo’s damage deposit and damage protection policy. A company like Superhog can offer an alternative, with coverage up to $5,000,000 — a thousand times more than Vrbo’s top level of Damage Deposit Protection ($5,000).

Vrbo requires property managers to file a claim for damage within 14 days of the guest checking out, but there is no guarantee of a quick payout in the event a claim is filed, because hosts must provide proof and documentation, and have Vrbo agree to it.

This could take a while and be complicated.

In contrast, using a third party company like Superhog lets you outsource your claim filing, with a dedicated team able to report, confirm, and manage the damage and claim, taking the complicated and time-consuming admin off your to-do list. This means that you are more likely to receive a payout, fast.

Yes. Vrbo Damage Protection only covers accidental, unintentional damage by any one of the guests (including pets listed on the booking); or theft or damage by someone other than the guests on the booking, if a police report is filed.

Vrbo policies do not include intentional damage by any of the guests or their companions, cleaning fees or deep cleaning, intentional theft by any of the guests, or pet damage if the pet was not agreed on the booking in advance. In contrast, a policy through a company like Superhog covers malicious damage.

Not within Vrbo itself. Hosts via Vrbo can only ask for one of three kinds of protection (a card on file, Accidental Damage Protection, or a refundable damage deposit).

The only way that a host can leverage a damage deposit and extra insurance protection would be to ask for a damage deposit through Vrbo, and cover their rental properties with a third-party damage deposit platform that is separate from Vrbo, such as Superhog. In fact, Superhog’s policies go far beyond the coverage offered by Vrbo.